SR Letter 11-7 Supervisory Guidance on Model Risk Management

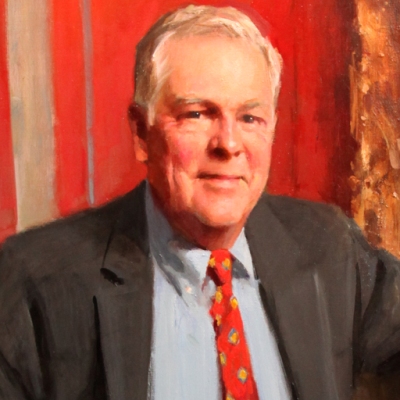

Speaker: Robert Geary

Speaker Designation: Founder, Greenwich Risk Management Advisory Services

Speaker: Robert Geary

Speaker Designation: Founder, Greenwich Risk Management Advisory Services

SR Letter 11-7 has become the premier standard for model risk management, with its principles being adopted not only by banks, but also by virtually all U.S. financial institutions.

It addresses model construction, validation and usage. It goes on to review model management responsibilities including oversight, governance and policies.

The guidance also cites the need for uniformity of model management and policies across businesses within an organization. This training program will detail why SR Letter 11-7 has become the gold standard for model risk management, with its principle being adopted not only by banks but also virtually all U.S. financial institutions.

Financial institutions rely on models and quantitative analysis to perform key activities such as investment valuations, risk management and liquidity and capital management. A sound management of the risks inherent in the use of mathematical models is imperative to reduce the risk of reliance on flawed or misapplied models. SR Letter 11-7, issued jointly by the Federal Reserve and OCC, provides comprehensive guidance for banks on effective model risk management.

Failure to validate models at the company level increases the risk of regulatory criticism, fines, and penalties.

This webinar will offer attendees an understanding of the background behind SR Letter 11-7. It will further discuss the purpose and scope behind the supervisory guidance on model risk management.

o CFOs

o COOs

o CROs

o CIOs

o CPAs

o CBAs

o CFEs

Robert Geary is the founder of Greenwich Risk Management Advisory Services "LLC" and services as the principal consultant on many of the firm’s consultancy mandates.

Robert has been a banking and finance industry professional for 43 years with 34 years serving in a variety of senior Treasury, financial market, asset management and risk management roles at JP Morgan Chase & Co. For the last 6 years of his career with JP Morgan Chase, Robert had undertaken risk management oversight roles that have included Head of Market, Credit and Operational Risk Management for Chase Asset Management and being Managing Director of Fiduciary Risk Management for the Corporation. During Robert’s career he has served on the Board of Directors of Chase Manhattan Overseas Banking Corporation as well as having served on numerous senior committees. Prior to joining Chase, he held positions at Chemical Bank, Chrysler Financial Corporation and National Bank of North America.

Robert holds a BA degree in Economics from Pace University and did graduate studies in finance at New York University Graduate School of Business. He is a Past President of the New York Athletic Club and is currently a member of the Executive Advisory Board of St. John’s University Department of Accounting and Taxation.